Markets move where the money moves. Just back in Q4 of 2021, Web3 Degens were aping into projects which provide supernormal returns of 100x or even 200x of profits (within days) on game tokens such as Cryptomines (ETERNAL), Monster Grand Prix (MGPX), Cryptogodz (GODZ). Today, these games have all died, and the focus have shifted from GameFi toward a booming NFT market. The question is whether NFT games are at the end of its cross-roads & what are the key challenges it faces today?

Defining Gamified NFT vs. NFT gaming

Before diving deep into the difference between NFTs and NFT gaming, it is essential to set clarity on the difference between gamified NFTs & NFT gaming. Gamified NFTs are for example Creepz.io, Voxxt, and Cyberkongz, where developers seek to gamify it by adding interactive utility such as staking of NFTs for reward, or mini games in their discord servers or websites which provides participation reward too. Usually, the objectives of such gamified NFTs are to encourage HODLing of NFTs, so as to reduce circulating supply of NFTs in the secondary market and increase floor prices. NFT gaming on the other hand, are for example Axie Infinity, Pegaxy, Last Survival, where the objective of it (supposedly but not always in reality) is to bring entertainment & enjoyment to players, while rewarding them for playing the game. However, the reality of how NFTs and NFT games turn out to become is not always as expected. In this article, I will be using NFT gaming & gamefi interchangeably, but they both mean the same.

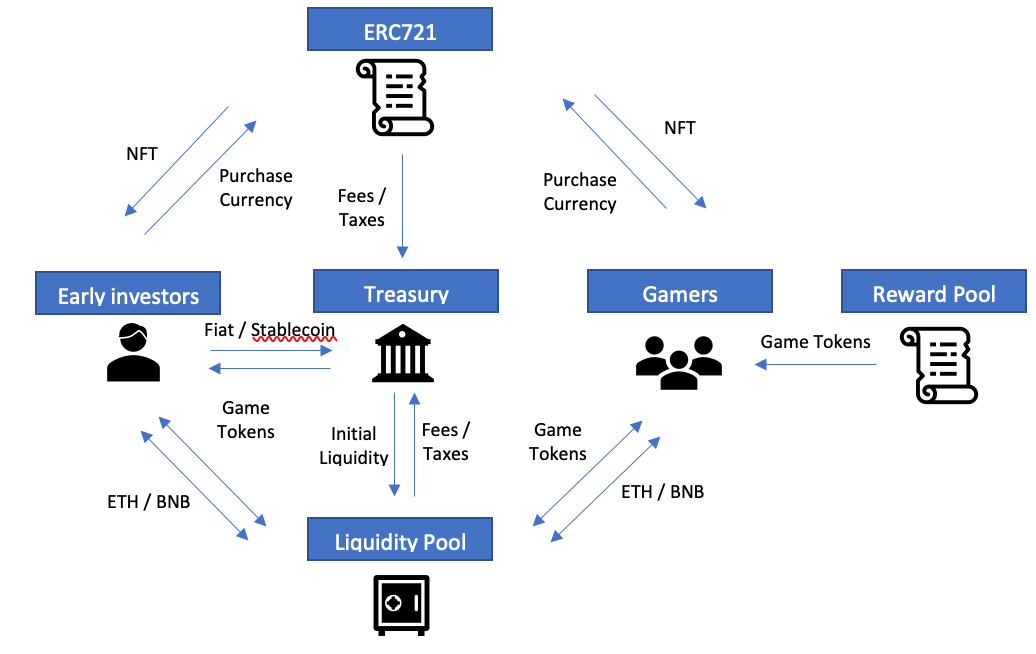

The diagram below is a simple illustration of a typical NFT gaming ecosystem. There are several challenges which the GameFi industry still faces today which Game studios are still finding solutions to them.

1. Misaligned interests in GameFi & NFTs

The interest & focus of the core team is not the same as that of investors & players. The key objective of any crypto project is supposedly to continuously develop and grow, expanding on partnerships, bringing more value to stakeholders overtime, rather than focusing on token prices. On the other hand, the key interest of users and investors (token investors) is to have appreciating token prices overtime. While many projects have vesting team tokens, the team have little to no incentive to focus on the token prices, partly given that it does not (or little) contribute to their revenue source most of the time. Rightfully, as per how traditional corporates work, as the company develops and expands on the value it brings to its stakeholders, market prices (coin prices) should follow suit.

To put into perspective, looking at the Game Ecosystem, the key interest of game creators often lie in bringing in early investors prior to the ICO, beefing up its treasury overtime and bringing in more gamers overtime. The key interest of gamers and investors, however, is the price of token itself, which is determined algorithmically via exchanges and the liquidity pool ratio. Most NFT gaming projects will see project owners raising funds from early investors, then allocating 5-10% of the funds raised for initial liquidity in liquidity pools and that is the last of their contribution to the liquidity pools. At the same time, supply pressure of game tokens in liquidity pools outweigh demand pressure overtime as early investors cash out vested tokens, and gamers cash out gaming rewards. Yes, it seems contradictory that gamers have the interest of increasing token prices but are the cause of high supply pressure and dipping token prices at the same time. A possible explanation for this is because NFT games are ultimately a zero-sum game & players in it are susceptible to the prisoners’ dilemma.

2. Zero-sum game & the prisoners’ dilemma

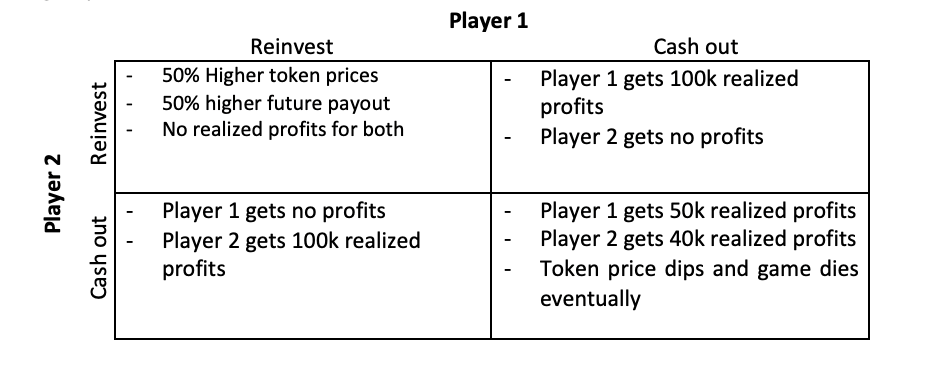

One of the key characteristics of Web3 & decentralization is the absence of a deciding government, and every individual has full control of buying and selling assets anytime they want. NFT gaming is in fact a zero-sum game as for every token seller who seeks to sell their tokens, a willing buyer is required.

The issue with NFT gaming (and even NFTs) is that similar to the prisoners’ dilemma, gamers are incentivized to choose in a way that creates a less than optimal outcome for the individuals as a group.

Taking the example of Pegaxy, pegaxy is a polygon based NFT horse racing game which features breeding, unlimited supply of reward tokens VIS (also required for breeding), governance token PGX (also required for breeding), an automatic scholarship system, and a player vs environment (PvE) gameplay where the top 3 pegas will split 175 VIS according to ranking.

Pegaxy scenario:

- At the early onset of the game when the price of VIS was 0.05, NFT holders may be incentivized to reinvest earnings into breeding of more Pegaxy rather than cashing out, knowing that the number of pegaxy owners in the game economy is insufficient to impact VIS prices significantly. This results in the burning of close to 100% of tokens minted from reward pool. (High burn rates for VIS)

- At the same time, word of mouth that pegaxy has earning potential spreads, building a growing community of players and scholars & a demand for VIS as the pace of breeding picks up. (Increasing demand for VIS)

- Overtime, the number of Pegas and players multiply and VIS prices went up to an all-time high of 0.26 and virgin Pegas were selling for 3k in the market.

- The prisoner’s dilemma here becomes of concern since if a pegaxy owner decides to reinvest his / her earnings into breeding pegaxy at this price, he / she will lose the opportunity of cashing out the earnings, incurring a huge opportunity cost especially if other NFT whales decide to cash-out their earnings.

- Hence, fearing that other owners will choose to cash out, the owner then decides to cash out rather than reinvesting into a new pega, causing an imbalance of mint – burn rate of VIS tokens. (supply pressure on VIS + decreased burn rates of VIS)

- The collective common mindset, plus falling prices, leads to big dumps until eventually people realize that it is not worth holding onto pegas and VIS anymore.

- The sucker becomes the one who holds on to the last bag of coins as he / she is unable to find a willing buyer given that it is a zero-sum game.

3. Imbalance of value creators & value extractors

Another pressing issue the NFT gaming face today is the imbalance of value creators and value extractors. Yes, early investors such as your venture capitals, angel investors and GameFi degens pump capital into the project at its onset, creating monetary value & enabling development of the project. However, these “value creators” who enter the game, will at some point turn into “value extractors” as nobody will want to invest into a project knowing they are going to make a loss. In other words, early investors choose to invest as they believe these projects will provide greater value in the long-run. Here lies a major flaw in the concept of “Play-to-earn”: Players are mostly short-term value creators who seek to become value extractors and get rich quick. As more players join the community and play the game, the number of value extractors multiply. Once new player growth plateaus off, the amount of value creators outweigh the amount of value extractors, leading to the eventual stagnation, or even death of the project. It is difficult to understand this concept without having first-hand experience on these games, but I will attempt to exemplify it.

Linking again to the case of Pegaxy, a gamer who invests 2k to buy his / her first 2 pegas will most likely seek to recover his / her cost by cashing out rewarded VIS first, before reinvesting VIS rewarded into breeding of new pegas. The initial investment of 2k is the value creation gamers bring about, and probably a one-time off investment, while the phase of breeding or reinvestment is where rewarded tokens are burnt instead of being cashed out. These players will eventually stop breeding new pegas and start extracting bulk value from the liquidity pool. Eventually, there comes a point at which the amount of monetary value being extracted from the LP outweighs the amount of value being injected in it, and the project will start to see pessimism, FUD and eventual winter season.

Concluding remarks: My perspective of how NFT gaming should progress

Many at times, these games die out, leading to early investors losing their investment wholly. I believe the key issue here is that the GameFi industry is still at its early stages. Game studios are still trying to understand how the whole ecosystem works and are still looking for the best solution. However, the perspective and angle of which these projects are looking at to problem solve is where the error lies in my opinion. Many developers I speak to today will share about their tokenomy, utility, team, roadmap etc, just like a normal pitch. However, they do not share about how their project effectively addresses the issues talked about above.

Having a single token and fundraising from early-stage investors places them at risk of having all their potential value being extracted even before the roadmap of the project can be completed. There are also other factors, such as games not being fun to play, which pose challenges to the industry today. Ultimately, an economy will never be sustainable without a healthy balance of value creators & value extractors.

Have you ever wondered why similar game tokens are being rewarded to gamers as the tokens that are given to early investors? If we compare this to equity markets, it is as good as rewarding gamers equity tokens for playing the game. Is this really the way to go? NFT gaming is still at its nascent stages.