My first introduction to the world of Play to Earn (P2E) gaming was when Axie Infinity was making headlines all over the world. For those of you who haven’t heard of Axie, it’s basically a Pokemon-like game where players buy Axies (characters) as NFT’s from the secondary marketplace to battle against each other and earn SLP. SLP (Sweet Love Potion) is a cryptocurrency that exists solely for the purpose of the game Axie Infinity, and outside of the game’s ecosystem, this (crypto)token has no particular utility or value. Axie also has a second token, called AXS. This is their governance token, which definitely plays a role in their economy, but for the simplicity of this article we’re going to leave AXS out of focus.

Now in order to play this game, you need to buy 3 Axies from other players so that you have a squad in order to battle. At its peak hype, the price of one Axie was about $250 - $500, and although the team behind the game have since taken measures to reduce these prices, there were still plenty of people waiting in line to buy these Axies and play this game at these inflated prices.

What made Axie so unique and interesting, was their breeding mechanic. When the game launched, there were only a few Axies in existence. The team had programmed the game so that they couldn’t just create new ones out of thin air. Instead, owners of Axies could trade in their earnt SLP tokens and breed two of their Axie NFT’s to create an entirely new Axie NFT. This new NFT could then be sold to a new player wanting to get into the game, most likely for a price (paid in Ethereum) that was higher than the cost of the SLP tokens required to breed it.

In this example, a player has 2 Axie NFT’s and would spend 200 SLP tokens (and 1 AXS) in order to create a brand new NFT.

And thus, a new type of game economy was created. Where existing players can use their NFT’s to earn tokens, and then use those tokens to create new NFT’s, to sell to new players who want to get in the game.

As word got out about people earning a reasonable amount of money from battling pokemon like characters, demand for Axie NFT’s and SLP tokens skyrocketed. This led to a major price increase of both NFT and SLP, meaning that old players in the ecosystem were only making larger profits, creating even more hype and demand. Interestingly, during the worldwide COVID lockdown, many communities in the Philippines started playing Axie Infinity and earning more from their daily gaming sessions than in their real-life day jobs. Even now, more than half of Axie’s gaming population comes from developing countries with low average incomes.

(great mini-documentary about this)

But as the game got bigger, problems arose. Axie infinity’s economy was never designed to sustain such an explosive growth. Players soon realised that it was more profitable to use Axies to gain SLP than it was to just sell the Axies they were breeding, as this would allow them to scale their earnings. With this thought, a whole new system of ‘scholarships’ was created, where Axie NFT holders would ‘lend’ out their NFT’s to players trying to get in the game, that couldn’t afford the high NFT prices. Players lending an Axie, referred to as ‘scholars’ would then do the daily SLP griding, and keep a percentage of their SLP earning as their ‘manager’ took their cut.

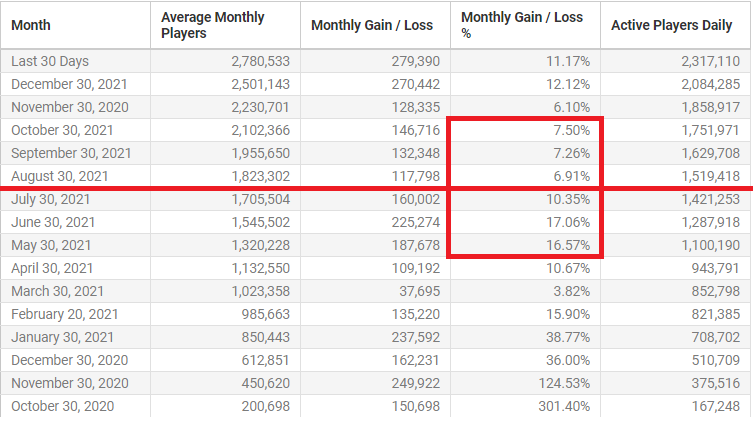

Although these scholarships seemed like an affordable solution for new players trying to get in the game, in reality, it only meant that the cost of buying an NFT would get more expensive, as holders became increasingly reluctant to sell. All of this demand peaked between May and July 2021, when the maximum price of 1 SLP reached about 0.35$. Old players that had scaled up into scholarships had amassed fortunes and started cashing out.

With the economy being so propped up, with Axies breeding exponentially and an infinite supply of SLP that kept flowing into the economy, things took a turn for the worse. All it took was a small, temporary decline in player growth. August 2021 saw player growth decline to single digits, for the first time since the start of the peak period back in May.

With Axie supply still growing exponentially, there suddenly weren’t enough new players trying to enter the space to keep up the balance. The minute some of the larger SLP holders started selling their tokens to cover their exposure, panic ensued and the whole economy came crashing down.

Even now, as the player count of Axie Infinity keeps growing every month, the demand has yet to catch up with the exponentially increasing supply. The main issue, as many have highlighted, is that there are a lack of demand factors that reduce the supply of SLP, considering the massive amounts of SLP that are created on a daily basis. As the total supply of SLP keeps increasing, the price (or value) of it will keep getting lower (inflation).

At the same time, the supply of Axies is also only ever increasing. As of now, there are more than 7 million Axies in existence. 570,000 of these are for sale in their marketplace, even though the average player growth was 270,000 last month. In it’s current state, the game economics behind Axie Infinity are doomed to fail, yet luckily, the developers are working on creating new mechanics to solve these problems. The company behind Axie is still valued at over 3 billion dollars, as it managed to bring in over a billion dollars of revenue last year.

To conclude, the epic rise of Axie Infinity last year proves that there is enormous potential within the fast-growing Play-to-Earn gaming sector. Subsequently, the dramatic fall also shows that we have yet to figure out the perfect game economic balance that will create a sustainable and scalable P2E economy for the long-term.